Bsc. PROFESSIONAL Accounting

The Accountant in Business and Society

Coursework 1

SNR: 1036914

August 2014

Table of Contentss

Ethical determination devising theoretical accounts that may assist an comptroller to take part in determination devising in an ethical manner and pull off ethical quandary.

Philosophic attacks

Teleology

Deontology

Virtue Ethical motives

Traditional determination devising attacks

Tucker ‘s five inquiry ethical determination devising attack

Modified moral criterions attack

Modified Pastin Approach

Contrast regulation based and rule based attack to criterions and ordinances

Situations in which comptrollers are expected to move in the public involvement and abide by their professional criterions environment.

A impression that comptrollers should move in an ethical manner and if their behavior and determination devising should be influenced by moralss and moral codifications or self involvement position.

Appendixs:

Bibliography

a ) Ethical determination devising theoretical accounts that may assist an comptroller to take part in determination devising in an ethical manner and pull off ethical quandary.

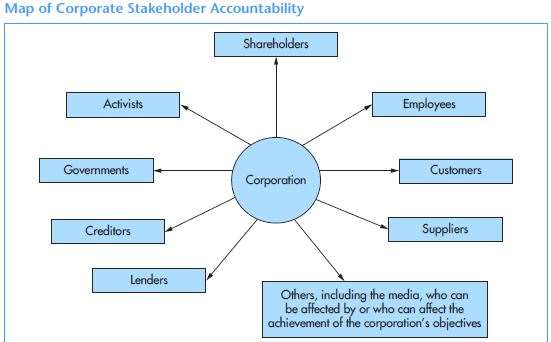

Ethical determination doing model advocators for professional comptrollers to use ethical rules and determination devising theoretical accounts while doing determinations. This safeguards the corporations ‘ ethical values, stakeholders ‘ involvements and strengthens corporate administration and mitigates hazards while disputing unethical determinations.

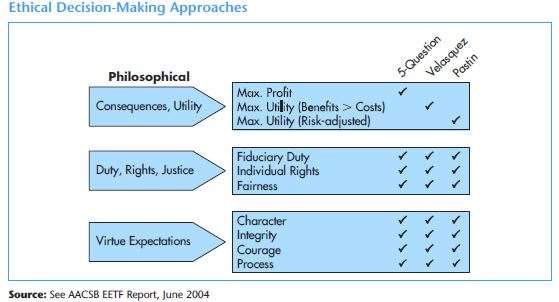

Accountants determinations should include both philosophical and practical attacks, integrating stakeholder impact analysis.

Beginning: Brooks and Dunn, 2012.

Philosophic attacks

Teleology

Harmonizing to this attack accountants ethical determination devising is based on effects. The result is right if it incorporates hazards and benefits of bulk stakeholders ‘ involvements and ignores the moral behavior. Concentrating on the results to increase gross might take to unethical determination devising. ( Brooks and Dunn, 2012 ) .

Deontology

Harmonizing to Immanuel Kant on Deontology logical thinking, comptrollers cognizing the moral purpose will find the actions to be taken during determination devising. Accountants are guided by codification of moralss and act objectively in their determination doing having fiducial responsibility, equity and justness to single and avoid struggle of involvement like was in the instance of Sears Auto Center. Directors sold unneeded services to clients by pull stringsing the company ‘s net incomes in order to increase the portion monetary value that boosted their stock addition instead than move in the best involvement of stakeholders ( Brooks and Dunn, 2012 ) .

Virtue Ethical motives

Aristotle, through virtuousness moralss approach focused on moral unity in determination devising. Accountants should exhibit unity and prudence in their work by supplying independent opinions in their determination devising and be loyal to their stakeholders. The combination of individual ‘s independency and good structured company nucleus values meets the stakeholders ‘ outlooks.

When Apple CEO reduced the monetary value of iPhone from $ 599 to $ 200 after two months of establishing it was criticised. Harmonizing to teleology, the result was right since the satisfied clients outweighed the disgruntled. Harmonizing to deontology, Apple needed to pay discounts since they were cognizant of the moral purpose of bear downing high monetary value. Virtue moralss argued that the CEO ‘s unity by offering discounts and apologies was compromised contrary to Apple ‘s nucleus value of run intoing stakeholders ‘ outlooks ( Brooks and Dunn, 2012 ) .

Practical determination devising attacks

Tucker ‘s five inquiry attack

It is an ethical analysis tool that tests the proposed determinations to guarantee they are right utilizing five inquiries ; is it profitable, legal, just, right or sustainable.

Accountants should implement this attack and challenge administrations ‘ actions and determination devising proposals to guarantee they run into stakeholders ‘ outlooks.

If Apple comptrollers had used Tucker ‘s attack they could hold challenged the CEO ‘s determination devising on cut downing the cost of their iphone to integrate stakeholders ‘ involvements. This could hold prevented ailments from unsated clients and maintained Apple ‘s nucleus values ( Appendix 1 ) .

Moral criterions attack ( Velasquez )

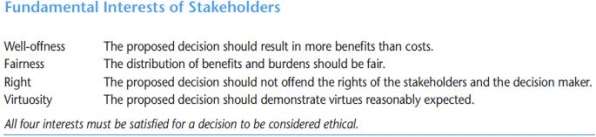

Velasquez focused on four stakeholders involvements to be met before an ethical determination was made.

Beginning: Brooks and Dunn, 2012

Harmonizing to this attack comptrollers should see stakeholders ‘ involvements every bit good as company profitableness in their determination devising. The determination is deemed ethical if it benefits the society, it is just and right to stakeholders and meets their outlooks. ( appendix 2 ) .

Recent corporate dirts reflected deficiency of stakeholders accountability in their determination devising, instead they were based on self involvement facilitated by bureaucratism, authorization, greed, bullying and net incomes. Enron ‘s prostration reflected deficiency of objectiveness and struggle of involvement in determination devising by comptrollers.

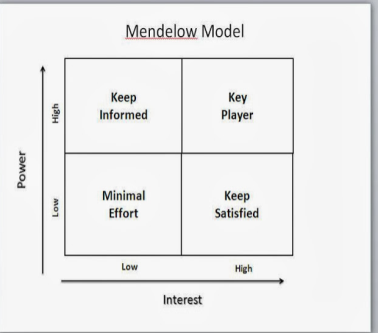

This attack relates to Mendelow matrix that explains the ranking of stakeholders harmonizing to each power and involvement in the administration scheme ( Appendix 3 ) .

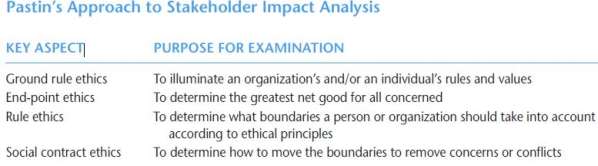

Pastin Approach

Pastin suggested that the proposed determinations be compared to the company ‘s land regulation moralss. By analyzing past determinations comptrollers can understand the administration ‘s values and avoid misdemeanor of cardinal rules, sing the facet of terminal point moralss on how to mensurate the impact of proposed determination to avoid booby traps. This will enable comptrollers to integrate moralss in determination devising and so set up an ethical administration civilization to run into its aims and fiducial responsibilities of stakeholders.

In the instance of Ford Pinto, they ignored the terminal point moralss when doing determination and merely focused on short term returns that resulted in higher costs than benefits ( Brook and Dunn, 2012 ) .

Beginning: Brooks and Dunn, 2012

Beginning: Brooks and Dunn, 2012

B ) Contrast regulation based and rule based attack to criterions and ordinances

Principle based attack is an administration pioneered robust counsel that is flexible to be applied in assorted fortunes in concern operations. It encourages professional comptrollers to use their opinions in finding fiscal coverage processs instead than clicking boxes.

Rule based attack is a conformity of enforceable normative counsel which is easy understood and followed ( ICAEW, codification of moralss ) .

Accountants follow regulations based attack when fixing fiscal statements, decreasing the jurisprudence suits against them as their opinion is based on regulations instead than personal opinion.

Rules make it clear what a company must make and its staying therefore making assurance due to compliance which can be measured and consistent criterion coverage that is easy for comparison with other administrations.

This might non cover every facet and might be misinterpreted if excessively complex making unneeded complexness. The regulations inflexibleness may impede independent opinion and agnosticism by comptrollers.

Sarbanes-Oxley statute law is an illustration of regulations based system that brought corporate administration reforms in USA capital markets after the corporate dirts ( Brooks and Dunn, 2012 )

Principle based attack contains by and large accepted accounting criterions and non a set of regulations. The UK Corporate Governance Code is principle based and expects managers to unwrap if they are compliant or give grounds for non-compliance.

Its flexibleness influences comptrollers to be judgemental and independent in their determination devising to run into stakeholders ‘ involvements instead than click boxes.

The rules can be changed easy to suit specific state of affairss since no statutory demands are needed.

The international Federation of Association ( IFAC ) is a rule based system that articulates that professional comptrollers need to move in public involvement.

Cardinal rules province that comptrollers will move with unity, be accountable and responsible to the determinations they make.

Principle based guidelines are non mandatory, therefore inconsistent information can impede comparison with other companies and comptrollers might non be able to mensurate their conformity.

The Financial accounting criterion Board ( FASB ) criterions are rules based which argues if version of the rules instead than click boxes will control fiscal dirts.

The regulation based attack like Sarbanes-Oxley has led to entity transparence and ensured stakeholders involvements are met while IFAC criterions have emphasized on the public outlook by the professional comptrollers. This ensures entities ‘ aims are met and good administration is practiced ( Brooks and Dunn, 2012 ) .

degree Celsius ) Situations in which comptrollers are expected to move in the public involvement and abide by their professional criterions environment.

Professional comptrollers are expected to follow with Professional Code of Ethics while moving in public involvement to keep credibleness and assurance to the populace. ACCA codification of moralss has set cardinal rules that must be followed by professional comptrollers ( IFAC, 2012 ) .

Integrity

Accountants should hold ethical ethical motives of honestness in their professionalism to guarantee that stakeholders do non do incorrect economic determination as a consequence of misdirecting studies or material misstatements.

Giving modified study that affect company ‘s image and stakeholders ‘ assurance is moving ethically and professionally in the public involvement and safeguarding the entity.

Objectivity

Professional comptrollers should hold the ability to do independent opinion without gratuitous influence or struggle of involvement. Most corporate fiscal mistakes are caused by judgemental mistakes.

Receiving a large proportion of accounting fees from one client by supplying other services might compromise independency for fright of losing the client. In public involvement large houses offering services seems like an advantage of cost effectual. Accountants should promote variegation of services to other houses to safeguard independency.

Confidentiality

Client information obtained during accounting professional relationship should non be used for personal addition or disclosed to the 3rd parties unless there is a legal responsibility for revelation. If the client is covering with illegal concerns like money laundering, corruptness or graft revelation is for public involvement to halt condemnable activities ( IFAC, 2006 ) .

Accountancy house covering with one client for a long clip might compromise confidentiality ensuing in acquaintance job. To move in best involvement of the populace, revolving staff might extenuate the hazards.

Professional competency and due attention

Accountants should hold expertness in accounting both accomplishments and cognition and keep a uninterrupted preparation to maintain up to day of the month. Attachment to professional criterions and moving diligently to supply fiducial responsibility to stakeholders ( CIMA,2010 ) .

Professional behavior

Accountants should follow with needed ordinances and Torahs and handle all clients with diligence to keep good professional repute and avoid doubtful actions ( ACCA, 2011 ) .

The comptrollers specialised accomplishments, ordinances like SOX, IFRS and good corporate administration facilitate meeting stakeholders outlooks.

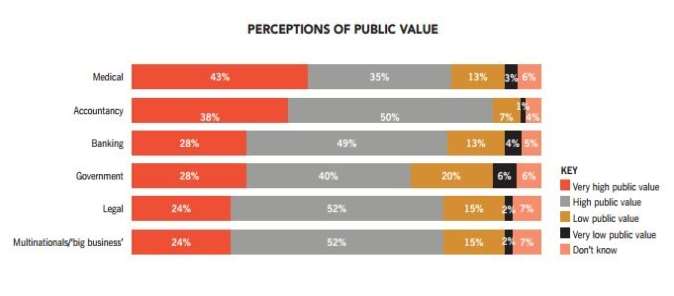

A study carried out by ACCA showed accounting was rated 2nd with 38 % after medical profession with 43 % . Accountancy had high participant value of 88 % as compared to medical profession of 78 % and banking 77 % ( ACCA,2011 ) .

Beginning, ACCA study

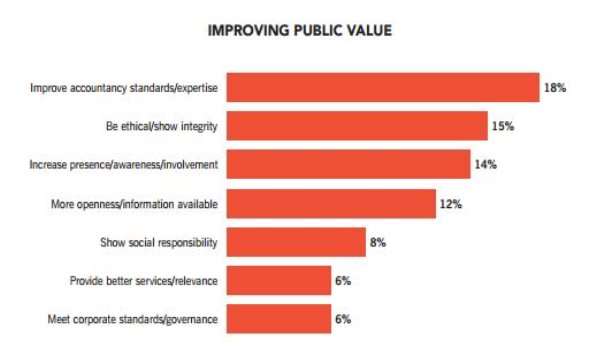

To better public value the respondents emphasized that accounting ethical criterions, consistence, good societal duty, corporate administration and general consciousness will advance credibleness, assurance and repute to the populace. Beginning, ACCA study

Beginning, ACCA study

vitamin D ) A impression that comptrollers should move in an ethical manner and if their behavior and determination devising should be influenced by moralss and moral codifications or self involvement position.

Professional comptrollers are expected to adhere to professional codification of moralss in determination devising to run into the stakeholders involvement instead than move for self addition. The IFAC codifications establishes the rules to be followed by professional comptrollers ; Professional behavior, unity, objectiveness, confidentiality and professional competency and due attention ( IFAC, 2006 ) .

Accountants are faced with ethical quandary of self involvement and moral values while doing determination opinion to safeguard stakeholders involvements. Kohlberg came up with six phases of motive that influence people in moral logical thinking ( Appendix 6 ) .

Pre-conventional degree

Accountants determination devising should be governed by codifications of moralss non be motivated by penalty or wagess. Unethical corporate wages system might actuate comptroller to move unethically and manipulate figures to accomplish their marks and acquire their wages but this might be against stakeholders ‘ involvement.

Accountants moral purpose should non be motivated by personal addition instead a moral behavior facilitated by professional competency and accomplishments should be applied. This will avoid struggle of involvement and cut down corporation hazards while run intoing stakeholders ‘ outlooks and disputing unethical corporate behaviors that might travel unpunished.

Accountants should non merely concentrate their determinations on legalities to avoid penalty, but should guarantee that society involvements are non lagged behind by the Torahs. Use of rules codifications of moralss give the comptrollers flexibleness to exert their opinion in determination devising and dispute bad patterns. If use of WorldCom accounting by Ebber was challenged, investors returns could hold been protected.

Conventional degree

Accountants should non be influenced by unethical corporate civilization, deficient corporate values, group norms and unrealistic schemes while doing determinations.

They should move morally and diligently to safeguard stockholders wealth from unjust trades owing fiducial responsibility. Enron comptrollers did non dispute the hazardous concern operations of O.K.ing the fiscal manager private fund investing. This reflected deficiency of independent opinion to observe ethical menaces and safe guard stakeholders ‘ wealth taking to prostration of the company.

An unethical pattern might be deemed ethical in a corporate group and an comptroller should utilize professional opinion in determination devising to guarantee group involvement does non outweigh public involvement.

Post-conventional degree

Kohlberg stated that persons should be able to develop independent determinations based on rights and rules and that comptrollers should accept legal duty for determinations they make.

Accountants should move morally and reasonably, integrating stakeholders group involvements and powers while doing determinations to avoid disregarding the least stakeholders.

Accountants should move with unity and honestness in their determination devising and avoid giving incorrect information to hike gross revenues. Acting morally and stating the truth will be run intoing expected moral virtuousnesss.

Accountants should be able to interrupt bad jurisprudence and accept penalty every bit long as he can warrant he acted in the best involvement of the society. WorldCom comptrollers could hold challenged subscribing for unethical trades utilizing their opinion and face dismissal which they could hold sought legal power or whistle blowing in populace ‘s best involvement.

Professional comptrollers need to hold accomplishments and be doubting in fixing fiscal statements to guarantee conformity with IFRS. ( Brooks and Dunn, 2012 ) .

Appendixs:

Appendix 1

Tucker ‘s five inquiry ethical determination devising attack

- Is itprofitableto the stockholders? Apple direction demand to maximise stockholders ‘ wealth

- Is itlegalto the full society? Price skimming is a legal pricing scheme for launched advanced merchandises and no breach of consumer protection.

- Is itcarnivalto all? could impact Apple ‘s repute if deemed unethical

- Is itrightto all? Not to the people who complained

- is itenvironment sustainable? ? presently non applicable

Appendix 2

Beginning: Brooks and Dunn, 2012

Appendix 3

Appendix 4

Kohlberg six phases

|

Degrees |

Phases |

Social orientation |

|

Pre conventional |

1 |

Reward or penalty Individuality and societal exchange |

|

2 |

||

|

Conventional |

3 |

Interpersonal relationship Law and responsibility |

|

4 |

||

|

Post-conventional |

5 |

Social contracts Cosmopolitan rules. |

|

6 |

Mentions

ACCA. ( 2008 ) .Ethical determination making.Available: hypertext transfer protocol: //www2.accaglobal.com/pubs/students/publications/student_accountant/archive/sa_mar08_campbell.pdf. Last accessed 19/07/2014.

Brooks, cubic decimeter Dunn, P ( 2012 ) .Business and Professional Ethical motives. Canada: Nelson instruction.

Gray, R, Owen, D and Adams C ( 1996 ) . Accounting and Accountability Prentice Hall, London.

Prentice Hall, London.

ICAEW. ( 2012 ) .Acting in public involvement.Available: hypertext transfer protocol: //www.icaew.com/~/media/Files/Technical/Ethics/public-int-rep-web.pdf. Last accessed 7/07/2014.

ICAEW. ( 2012 ) .Public involvement.Available: hypertext transfer protocol: //www.icaew.com/en/technical/ethics/the-public-interest. Last accessed 22/07/2014.

ICAEW. ( 2014 ) .code of ethics.Available: hypertext transfer protocol: //www.icaew.com/en. Last accessed 12/07/2014.

ICAEW. ( 2014 ) .Rule based versus rule based attack.Available: hypertext transfer protocol: //www.icaew.com/en/technical/ethics/practice-business-ethics/general-ethics/principles-versus-rules-debate. Last accessed 26/07/2014.

IFAC. ( 2005 ) .codification of moralss.Available: hypertext transfer protocol: //www.ifac.org/sites/default/files/publications/files/ifac-code-of-ethics-for.pdf. Last accessed 12/07/2014.

IFAC. ( 2014 ) .Public interest.Available: hypertext transfer protocol: //www.ifac.org/publications-resources/definition-public-interest. Last accessed 22/07/2014.

Solomon, J ( 2010 ) .Corporate Governance and answerability. 3rd erectile dysfunction. United kingdom: John Wiley & A ; boies ltd.

You tube. ( 2014 ) .Business moralss.Available: hypertext transfer protocol: //www.youtube.com/watch? v=3TFIg3yy9vI. Last accessed 15/07/2014

You tube. ( 2014 ) .Ethical determination devising.Available: hypertext transfer protocol: //youtu.be/nKN0lcTPaPU. Last accessed 16/06/2014.

Bibliography

CIMA. ( 2014 ) .Ethical quandary.Available: H hypertext transfer protocol: //www.cimaglobal.com/Documents/Professional moralss docs/code FINAL.pdf. Last accessed 16/06/2014

Crane, A. & A ; Matten, D. ( 2003 ) . Business Ethical motives Oxford: Oxford University Press.

Oxford: Oxford University Press.

Gray, R, Owen, D and Adams C ( 1996 ) . Accounting and Accountability Prentice Hall, London.

Prentice Hall, London.

IFRS. ( 2014 ) .INTERNATIONAL FINANCIAL REPORTING.Available: IASB, ( 2011a ) , Conceptual Framework, International Financial Reporting Standards 2011, IASCF, London. Last accessed 20/07/2014.

Monks, A. G. and Minow, N Corporate Administration Third edition. Malden MA: Blackwell.

Third edition. Malden MA: Blackwell.

Solomon, J ( 2006 ) . Corporate Administration and Accountability Chichester: John Wiley and Sons.

Chichester: John Wiley and Sons.

You tube. ( 2014 ) .Ethical motives.Available: hypertext transfer protocol: //www.youtube.com/watch? v=SBvyw2cXiBc & A ; feature=youtu.be. Last accessed 17/07/2014.