Executive Summary

The rubric of this assignment is Public Bank Group and it consists of a sum of three subdivisions in this assignment. The first subdivision explains about the scheme and mission statement that practiced by Public Bank, and the linkage between scheme and mission statement of Public Bank.

The 2nd subdivision of the assignment explains about the organisation construction design of Public Bank and what is the importance and forte of the construction that applied by Public Bank.

The last subdivision of the assignment contains of the competition arise between Public Bank, Maybank, and CIMB Bank. Besides that, I would take SWOT analysis to analyse the competition arise between its rivals in order to cognize whose is better.

Assorted methods have been used to research for findings such as interview, e-brary, cyberspace, and books.

Table of Contentss

Executive Summary

Table of Contentss

1.0 Introduction

2.0 Mission Statement and Strategy of Public Bank

2.1 Mission of Public Bank Group

2.2 The linkage between Mission of and Strategy of the Public Bank Group

2.3 Drumhead

3.0 Organization Structure Design of the Public Bank Group

3.1 Interviewee Statement

3.2 Divisional Structure of Public Bank Jalan Yang Kalsom

3.3 Drumhead

4.0 Competition Arise between Public Bank, Maybank and CIMB Bank

4.1 Identify the Public Bank Group’s Rivals

4.2 SWOT Analysis

4.3 Drumhead

5.0 Conclusion and Recommendations

6.0 Mentions

7.0 Appendix

1.0 Introduction

Strategic direction is a set of managerial determinations and actions that determine the long tally public presentation of a corporation as stated in Strategic direction and concern policy ( Wheelen and Hunger, 2012 ) .

The assignment rubric is about Public Bank Group in Malaysia. Public Bank Group is the 3rd largest banking group in Malaysia by plus size with entire assets of RM305.73 billion as at the terminal of 2013, and is ranked 2nd among all the public listed companies on Bursa Malaysia Securities in footings of market capitalisation.

There are entire of three subdivisions in the assignment. Section one will be covering the scheme and mission statement that practiced by Public Bank Group. Furthermore, subdivision two will be covering the organisation construction design that applied by Public Bank Group while subdivision three will be covering the competition arise between Public Bank Group and its rivals which is CIMB Bank and Maybank.

2.0 Mission Statement and Strategy of Public Bank

Based on the Idaho National Laboratory ( Inlportal.inl.gov, 2014 ) , Mission Definition consists of those actions taken to specify the mission for a system and the environment that affects its executing. The mission statement must specify the bing status that justifies the plan or undertaking demand, the coveted terminal province or merchandise ( s ) , and the public presentation outlook.

2.1 Mission of Public Bank Group

Harmonizing to the one-year study of Public Bank Group ( Public Bank Berhad, 2013 ) , the corporate mission of Public Bank Group is to prolong the place of being the most efficient, profitable and respected premier fiscal establishment in Malaysia. To accomplish the corporate mission, Public Bank Group will hold a corporate scheme that sets out what its long-run aims are in footings of what concern it plans to be involved and concern scheme that sets out how the organisation plans to win in a given concern country.

2.2 The linkage between Mission of and Strategy of the Public Bank Group

As we mentioned earlier, Public Bank Group adopts corporate scheme that focused on consistent growing scheme, which is to prosecute organic growing in the retail banking concern concentrating on the broad-based retail consumers and small-and moderate-sized endeavors ( “ SMEs ” ) , and strives to farther increase its leading in the retail banking market as stated in official web site of Public Bank Group ( Pbebank.com, n.d. ) .

A recent article ( Nickols, 2011 ) , stated that a scheme or general program of action might be formulated for wide, long-run, corporate ends and aims, for more specific concern unit ends and aims, or for a functional unit, even one every bit little as a cost centre. There are different degrees of scheme within an organisation which is corporate scheme, concern scheme and functional scheme.

Corporate scheme ( Yunizal Arief, 2014 ) , is a scheme of corporate that requires the company’s top directors and determination addressed to the satisfaction of the stakeholders of the company. The directors at the corporate degree by and large make up one’s mind what sort of concern to be conducted to bring forth long-run net income maximization and better the company’s gross stockholders. Furthermore, corporate scheme can take for growing, stableness or reclamation. The Unlocking the concern environment ( Brinkman, 2010 ) , published that a growing scheme aims to increase the sum of concern undertaken by spread outing the scope of merchandises or services, and the markets it serves.

As defined in Strategic direction ( Dess and Miller, 1993 ) , concern scheme is all about how houses compete, and in concern, competition is all about value: making it and capturing it.

From the information above, we can reason that the schemes that practiced by Public Bank Group are able to accomplish their mission statement because the schemes and mission statement are interrelated. Therefore, to accomplish the place of being the most profitable, Public Bank Group adopts corporate scheme that focused on consistent growing scheme. Harmonizing to Ivey Business Journal ( Liabotis, 2007 ) , far excessively many companies fail to accomplish their growing marks in gross and profitableness. However, the chance of accomplishing profitable growing is heightened whenever an organisation has a clear growing scheme and strong executing substructure. One without the other impairs the chance of success.

Furthermore, to prolong the place of being the most efficient, Public Bank Group adopts concern scheme that focused on the Group ‘s retail banking concern continues to aim retail consumer and commercial loans and funding, sedimentations and fee-based concerns. Besides that, to drive concern growing and increase its market portion in retail banking, the Public Bank Group leverages on its well-established client service substructure, procedures and patterns to present prompt and consistent service to run into the demands of its clients. As stated by The Boston Group ( Leichtfuss et al. , 2010 ) , Banks should take stairss to ingrain cost efficiency by industrialising procedures, set uping cardinal or regional processing centres, and developing IT and operations platforms. Therefore, all Bankss will be forced to better their procedure efficiency in the coming old ages, non merely to cut down costs but besides better client service.

2.3 Drumhead

By analysing the Public Bank Group’s scheme through the one-year study 2013, we could reason that Public Bank Group able to accomplish the mission statement as mentioned above.

3.0 Organization Structure Design of the Public Bank Group

Based on Unlocking the concern environment ( Brinkman, 2010 ) , the manner an organisation organizes itself in footings of who does desire, and who reports to whom, is fundamentally what organisational construction is concerned with.

The construction of an organisation needs to guarantee that it is able to accomplish its mission and aims in an effectual and efficient mode. In other words, an organisation needs to be structured in an appropriate manner to acquire things done, while besides enabling a grade of flexibleness that will enable it to run into what can frequently be fast paced alterations in the external concern environment.

Sometimes, direction may make up one’s mind that the construction of an organisation needs to alter, and this is referred to as organisational design.

3.1 Interviewee Statement

Name: Sarah Choong Suet Yee

Position: Senior Financial Executive

- What is the organisational construction of this subdivision?

- One subdivision director

- One Business Managers ( loan and mortgage )

- Assistant subdivision director ( operation )

Departments:

- SOO- Senior Operation Officer

- OO- Operation Officer

- OIC- Officer in Charge

- What are the classs of section in this subdivision?

- Investing – insurance & A ; unit trust

- Credit Card – recognition card & A ; safety box

- Customer Service – Customer service representatives ( CSR )

- Operationss ( Teller, under control of OO )

3.2 Divisional Structure of Public Bank Jalan Yang Kalsom

As stated by Strategic Management ( Miller and Dess, 1998 ) , a divisional or strategic concern unit ( SBU ) is a construction covers a set of comparatively independent entities governed by a cardinal disposal.

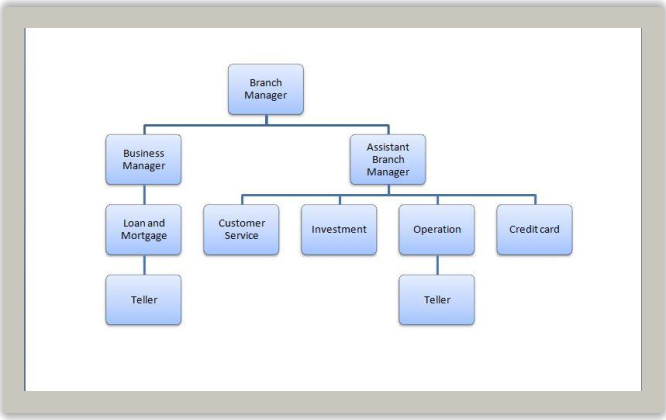

Harmonizing to Miss Choong the Senior Financial Executive of Public Bank Group in Ipoh Jalan Yang Kalsom Branch, the organisation construction that applied by Public Bank is one subdivision director, one concern troughs ( loan and mortgage ) and adjunct subdivision director ( operation ) . Hence, I assumed that the organisation construction that applied by Public Bank Group is divisional construction.

As the figure above, subdivision director is ranked highest place in the Public Bank Branch Jalan Yang Kalsom. The subdivision director of Public Bank Jalan Yang Kalsom will make up one’s mind the concluding determination of all the planning and waies. After that, the concern trough and the helper subdivision director will be in-charge on the loan and mortgage unit. Furthermore, the helper subdivision director will be in-charge on the client service unit, investing unit, operation unit and recognition card unit. For illustration, a client is confronting history jobs so the client will be served by the officer at client service unit.

The divisional construction is of import to the Public Bank Group because it helps organisation to avoid many jobs typically found in organisations structured by map. Furthermore, directors can more dressed ore on their ain peculiar merchandise lines and markets, and they have entree to resources and staff functional specializers. Delegating determination devising to take down managerial degrees moves determinations closer to merchandises and markets, which facilitates faster determinations from those who are more specialised and knowing in the merchandise country. This allows a high grade of accent to be placed on merchandises and markets. Besides that, it besides improves a firm’s ability to accommodate during rapid environmental alteration.

3.3 Drumhead

In short, the organisation construction design is really of import to all the organisations particularly Public Bank Group. The divisional construction helps Public Bank Group to avoid many jobs typically found in organisation structured by map.

4.0 Competition Arise between Public Bank, Maybank and CIMB Bank

When there is competition arise between Public Bank, Maybank, and CIMB Bank, Public Bank needs to happen out about its rivals. The first measure is rival analysis which is the procedure of placing cardinal rivals ; measuring their aims, schemes, strengths, and failings. In this manner, the company would be able to happen countries of possible competitory advantages and disadvantages as stated in the Principles of Marketing ( Kotler and Armstrong, 1991 ) .

4.2 SWOT Analysis

In this subdivision, I will utilize SWOT analysis to analyse the competition arise between Public Bank, Maybank, and CIMB Bank. Based on The Principles of Marketing ( Kotler and Armstrong, 1991 ) , SWOT analysis is an overall rating of the company’s strengths, failings, chances, and menaces. Strengths include internal capablenesss, resources, and positive stuational factors that may assist the company to function its clients and accomplish its aims. Failings include internal restrictions and negative stituational factors that may interfere with the company’s public presentation. Opportunities are favourable factors or tendencies in the external environment that the company may be able to work to its advantage. And menaces are unfavourable external factors or tendencies that may show challenges to public presentation.

4.3 Drumhead

As the illustrated on Table 1, I’m assume that the scheme used by Public Bank is better than Maybank and CIMB Bank because Public Bank has the nucleus competences with the higher one-year returns increasing yearly and unbroken net income path record of their group. Harmonizing to the Pubic Bank Investor Presentation Citi ASEAN Investor Conference 2014 Singapore ( Public Bank Berhad, 2014 ) , Public Bank has 47 old ages of unbroken profitableness and healthy net income growing in the past 5 old ages.

5.0 Conclusion and Recommendations

Strategic direction is a set of managerial determinations and actions that determine the long-term public presentation of a corporation as stated in Strategic direction and concern policy ( Wheelen and Hunger, 2012 ) .

In subdivision 1, Public Bank Group has adopts the growing scheme and concern scheme in order to accomplish the corporate mission “To sustain the place of being the most efficient, profitable and respected premier fiscal establishment in Malaysia” .

In subdivision 2, the divisional construction has brings a batch of benefit to all the organisation particularly Public Bank Group where it helps the organisation to avoid many jobs typically found in organisations structured by map.

In subdivision 3, Public Bank is much better after compared with its rivals which is Maybank and CIMB Bank through the SWOT analysis.

Last but non least, the recommendation for the Public Bank Group is to maintain set more attempts on their development in order to accomplish and prolong the place of being the most efficient, profitable and respected premier fiscal establishment in Malaysia.