Runing Head: CASE STUDY – Accounting

California Sutter Health is a non-profit organisation which aims to run into assorted communities’ wellness attention needs. It chiefly serves those who do non hold adequate money to pay for their medical demands and other related wellness plans and services. In more than 100 towns in Northern California, Sutter Health has about 50,000 hospital employees including physicians, nurse, staff, voluntaries who offered compassionate attention to more than 10 million patients in 2011 ( Sutter Health, 2012, para.1 ) . In Souza and McCarty’s article in 2007,From Bottom to Exceed: How One Provider Retooled Its Collectionsdiscusses how Sutter Health System enhanced its income aggregation by revising its histories receivable aggregation procedure. This alteration in aggregation procedure resulted to non merely by increasing the gross aggregation but it has besides improved the civilization within the sections in charge of patient enrollment and gross aggregations. This paper shows how Sutter Health became one of the taking wellness attention suppliers in Northern California by bettering its accounting patterns specifically its gross aggregation procedure. This paper besides presents the instance drumhead discussing issues that Sutter Health faced, the solutions used and its results.

Case Summary

In 2006, Sutter Health Systems experienced an dismaying tendency of increasing histories receivable yearss outstanding, lessening in gross aggregations and uninterrupted one-year debts. During the same twelvemonth, a combination of increasing unemployment rate and economic downswing contributed to Sutter Health’s fiscal battle. To extinguish these fiscal issues, the organisation decided to implement new debt-collection policies to see if betterments could be achieved without holding farther capital outgos on new accounting system or section reorganisation. Sutter Health considered these two possible solutions as both can hold important fiscal impact on fixed costs.

Before implementing new schemes to better Sutter Health’s fiscal status, its direction identified two chief jobs. First is about the trouble to entree informations on operational and fiscal prosodies such as hard currency aggregations and histories receivable yearss. As a consequence, employees typically wait until the terminal of the month to look into advancement, topographic point points of mention and even when doing of import determinations to the company. Furthermore, the accounting procedure of patients in the infirmaries does non let directors to analyze and segregate informations or do information about demand. Therefore, Sutter Health depends peculiarly on qualified coder to make this studies, which often ended up to delaies when detecting and deciding jobs ( Souza and McCarty, 2007, p.68 ) . It merely means that Sutter Health hired particular coders since they are the lone 1s who can fix the studies. It is dearly-won for the company given that the procedure of designation, reappraisal and rectification of jobs within the studies were much hard.

The 2nd job is that Sutter Health’s direction do non have real-time information until the execution of a new gross aggregation scheme. They merely made usage of available records of outstanding histories. Consequently, accounting representatives can non verify the advancement of the analytics which they need in order to construct up productiveness and meet ends ( Souza and McCarty, 2007, p.70 ) . To extinguish these two jobs, Sutter Health adopted the Patient Financial Services ( PFS ) which includes effectual tools in bettering rates of debt collected.

Patient Financial Services Explained

Patient Financial Services or PFS has many benefits to patients. This system includes basic on-line payment map where patients have a secure and convenient shoping on their charge histories. It allows patient to reexamine infirmary measures, ask for a elaborate study, modify insurance information and update personal information in the infirmary records. It besides allows them to pull off their history through the cyberspace by doing monthly payments or utilizing a payment program. The system besides includes tutorial to assist patients understand Sutter Health’s charge processs, price reductions and fiscal aid to some patients. The charge statement given in PFS is different from statements billed by doctors ( Sutter Health, 2012 ) .. This pertains to doctors that are straight involved in patient’s intervention but may non hold seen the patient in individual. For case, a radiotherapist may construe a laboratory trial needed for a patient’s intervention. This radiotherapist is non required to put a personal meeting with the patient in order to analyse and construe findings. In this instance, Sutter Health gives separate charge information.

Traveling back to the point of position of Sutter Health, PFS system strengthened the entity’s Accounts Receivable histories for the ground that PFS permits future constructive alterations. Hence, PFS gives room for more quality advancement in future. This plan gives Sutter Health’s direction a opportunity to develop helpful solutions to the troubles it faces daily. One of the major jobs which the entity faced was the trouble to entree informations on operational and fiscal prosodies. Under PFS, directors focused on pull offing these prosodies that will let them to do timely determinations and create suited classs of action. It includes development of managerial studies that directors need in decision-making procedure. For describing intents, several prosodies were set including billed and unbilled A/R yearss, A/R per centum utilizing aging classs and the A/R yearss related to identify remunerator beginnings. Upon the appellation of relevant studies, the installing of computerized study author takes topographic point and each assigned director has a modified set of studies organized for usage as a control panel to look into advancement toward ends. Furthermore, they can besides make informal studies without the demand to subject a particular petition.

Another job faced by Sutter Health is deficiency of real-time information. The new PFS introduced more undertakings to employees which require them to concentrate on each patient histories so that there will be real-time analysis on enrollment procedures. This indispensable demand assured that troubles coming from the procedure were decently identified, analyzed and corrected real-time which is before dispatching a patient in the infirmary. For that ground, the creative activity of auxiliary constituent to the system took topographic point in order to decrease the repeating claims as observed in the Accounts Receivable subdivision. The creative activity of the Denial System allowed the PFS forces to detect in real-time, any signifier of reverse that could hold taken topographic point in the procedure of both enrollment and hallmark of patients in the infirmary. This system is utile in certain instances wherein there is deficiency of patient information since patients’ investment bankers were below 18 old ages old which makes them non qualified to accept any signifier of patient answerability and in instances where the patients are widows as recorded in their matrimonial position but listed a comparative as partner. Therefore, the new PFS system differs from the old PFS in footings of clip required to entree patient fiscal information in the infirmary. The new PFS system permits employees to raise consciousness on cases where patient’s histories need peculiar degrees of attending since employees can entree information on a real-time footing.

Achieved Consequences

Sutter Health put accent on the human resources direction as it established accomplishments developing plans to develop effectual communications accomplishments and an enhanced apprehension of the collected information in order to give dependable information to third parties particularly insurance companies for expense. In implementing new PFS system, it is necessary to re-orient the enrollment staff members about the aggregation of patient duty fees earlier or during admittance. The new PFS system needed preparation plan which includes intense three hr, practical class followed by a survey of online competence faculties that had to be finished as a pre-requisite before an employee receives a user ID. It is necessary for PFS employees to larn how to decently utilize the tools and execute the maps on new package. The first hr of the three-hour practical preparation Teachs employees the important theories and rules of successful receivables direction such as how to acknowledge jobs and do independent classs of action in work outing them, how to detect tendencies and use that informations to better public presentation, and how to utilize public presentation response-based results instead than merely activity.

PFS employees have taken this plan in order to remain employed. As a consequence, this preparation improved the competence degrees of the PFS employees without the demand for salary addition of more than $ 20 per hr. In add-on, there is no demand for Sutter Health to use more officially educated PFS staff members.

PFS has different set of tools that allowed its staff to transport out alone steps considered helpful in increasing general revenue-collection public presentation. First, the tools helped PFS staff to concentrate on accounting processs that work on cybernation of histories work files. As a consequence, there is a important decrease on work load physique up. The tools allowed the PFS employees to treat and set up patient-accounts in different and alone ways such as categorization by dollar sums, length of work and the client inside informations. Another consequence showed in Accounts Receivable section as the agreement and poster of income is set in a much faster rate compared to the traditional policies of debt aggregation. Last, PFS tools assisted employees in the class of puting patient-accounts in order to find the percentage-attained.

PFS allowed a convenient manner to cipher the mean day-to-day net incomes within a hebdomad and a month. This process guaranteed that general ends were met during the operation sing that pressing alterations were made for them to set up set-goals. PFS besides allowed the direction to make timely studies having the aging-analysis and the usage of impermanent Discharge Bill Analysis which assured that jobs were discussed and solutions were provided right off.

One of the achieved consequences in implementing PFS system is the decrease of A/R yearss outstanding from 65 yearss to 59 yearss which is three months. Decrease in mean aggregations per twenty-four hours resulted in around 13 million dollars per aggregation or an increased entire aggregation of $ 78 million dollars. The sum of the existent investing incurred was non examined in item in Souza’s article but it showed as made up of preparation capital and a study author. Upon the addition in mean aggregation of A/R in malice of disbursals incurred utilizing the new PFS system, Sutter Health’s top direction was really satisfied with its public presentation.

Alternate Solutions

The health care industry in the United States is often flooded by patients’ unpaid measures and outstanding medical disbursals. These issues add peculiarly to the increasing cost of health care. For a non-profit organisation such as Sutter Health, the deficiency of patient’s fiscal information makes it complicated to measure whether a certain patient-debtor can afford to pay his/her measure. To better debt aggregation procedure for this state of affairs, implementing an Adaptive Neuro-Fuzzy Inference System ( ANFIS ) is effectual ( Shi, Zurada, & A ; Guan, 2014, p. 2888-2897 ) . This engineering offers informations analysis and appraisal of records by health care company where there is understatement in bad debt histories. Harmonizing to a research made by Shi, Zurada, & A ; Guan ( 2014 ) , ANFIS is a practical system that has proved its truth when it comes to sorting possible bad debts for health care companies. It is besides utile in observing unusual instances or minutess that can be a possible beginning of histories receivable recovery.

Due to increasing studies about aggressive charge patterns, health care companies must re-evaluate its aggregation policies. For the same ground, the American Hospital Association ( AHA ) advocated to its members to reevaluate their charge and aggregation processs and imposts in 2003 ( Healthcare Financial Management Association, 2014, p. 2 ) . AHA recommends its members to hold certain alterations on policies and measure how the procedure takes topographic point through employees who work with patients.

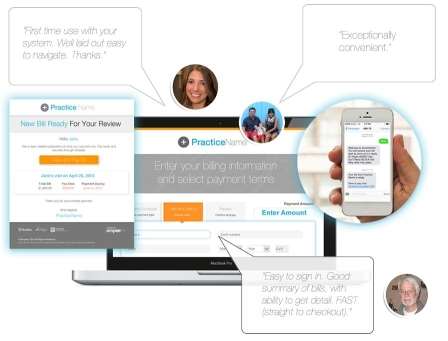

Figure 1. Patient Friendly Billing System. Retrieved from hypertext transfer protocol: //www2.simplee.com/product/patient-friendly-billing/ & gt ;

Specifically, AHA recommended Patient Friendly Billing system which offers tools and processs to assist retrieve from the issue of negative studies. Figure 1 shows the procedure of how patients entree and reexamine their infirmary measures through the Patient Friendly Billing System ( Simplificare Inc. , 2014 ) .

Decision

This paper showed how Sutter Health became one of the taking wellness attention suppliers in Northern California by bettering its accounting patterns specifically its gross aggregation procedure. This paper presented the instance drumhead discussing issues that Sutter Health faced such as the trouble to entree informations on operational and fiscal prosodies and the deficiency of real-time information. This paper showed Sutter Health’s solutions such as giving PFS employees intense three-hour preparation plan, creative activity of auxiliary constituent to the system which is the Denial System, and puting up of utile prosodies. The results of these solutions successfully contributed to do Sutter Health System become one of the most effectual techniques in debt aggregations in the United States.

Sutter Health System is a huge and complex health care entity. In decision, the constructs they have applied to reconstruct their aggregation processs and transform the organisation civilization includes elements that are extremely recommended and practiced in the health care industry. Having identified the benefits of PFS, it is now clear that each history units in Sutter Health develop operational schemes that focus on single-working units instead than different departments’ divider of informations. Furthermore, this paper showed that PFS has impact to all parties involved in wellness attention minutess such as the direction, employees, stakeholders and patients who are the chief receiving system of the PFS system’s benefits. In analysis of the preparation plan in Sutter Health systems, its benefits to employees and organisation civilization are long-run in nature. Last, PFS has brought newer accounting rules which have increased different department’s answerability. As a consequence, the hazard to embezzle resource financess is at lower limit.

Mentions

Guan, J. , Shi, D. , & A ; . Zurada, J. , ( 2014 ) . A Neuro-fuzzy Approach to Bad Debt Recovery in Healthcare.47th Hawaii International Conference on System Sciences, pp. 2888-2897. Retrieved from hypertext transfer protocol: //doi.ieeecomputersociety.org/10.1109/HICSS.2014.361 & gt ;

Healthcare Financial Management Association ( 2014 ) .Bad Debt Rising: When to Sell Your Histories Receivable. Retrieved from Premium Asset Recovery Corp. web site: hypertext transfer protocol: //www.healthleadersmedia.com/content/138293.pdf & gt ;

Simplificare Inc. ( 2014 ) . Know the Difference! See what ‘s following in Patient Friendly Billing® | Simplee. Retrieved June 11, 2014, from hypertext transfer protocol: //www2.simplee.com/product/patient-friendly-billing/ & gt ;

Souza, M. & A ; McCarty, B. ( 2007 ) . From underside to exceed:How one supplier retooled its aggregations[ Electronic version ].Healthcare Financial Management, 61 ( 9 ) , 67-73

Sutter Health ( 2012 ) .Sutter Health Care Network – Sutter Health 2011 Annual Report. RetrievedJune10, 2014, from hypertext transfer protocol: //www.sutterhealth.org/annualreport_2011/sutter-health.php & gt ;